south dakota property tax abatement

Thus even if home values increase by 10 property taxes will increase by no more than 3. Summary of HR2014 - 105th Congress 1997-1998.

Can A Small Business Get A Tax Refund

Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes.

. 1 2019 if the entity obtained a use tax permit prior to that date. Nevada Property Tax Rates. An overview of Minnesota and North Dakota sales and use tax laws for companies that do business in both.

Economic Revitalization Area Abatement for Real Property. Marketplace Sellers Sales Tax. Older homeowners and veterans often are entitled to a reduction of their property taxes.

The date the entity obtains a Texas use tax permit if obtained on or after Jan. Electronic services main page. Craft Shows Trade Shows Etc.

The first day of the federal income tax accounting period in which the taxable entity had gross receipts from business done in Texas of 500000 or more. The law limits increases in property taxes on primary residences to 3 per year. Taxpayer Relief Act of 1997.

Download Print e-File with TurboTax. Border Issues - MinnesotaNorth Dakota. Tax rates in Nevada are expressed in dollars per 100 in assessed value.

Address tax rate locator. Basic Sales and Use Tax. An introduction to sales and use tax in Minnesota including a section that explains how sales and use tax law applies to different types of businesses and their business activities.

2021 Taxpayers Notice to Initiate a Property Tax Appeal. Research lawyer attorneys law and legal research information. Find research resources and locate an attorney specializing in research.

Ordinarily youll have to apply for the abatement and provide proof of eligibility. Each state has property tax abatement reduction or exemption programs that allow specific homeowners to reduce the amount of property tax they must pay based on age disability income or personal status. Download Print e-File with TurboTax.

Download Print e-File with TurboTax. Im being audited what now. 2019 Claim for Homestead Property Tax Standard Supplemental Deduction.

List of State holidays when offices are closed. Computer Assisted Mass Appraisal Section.

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

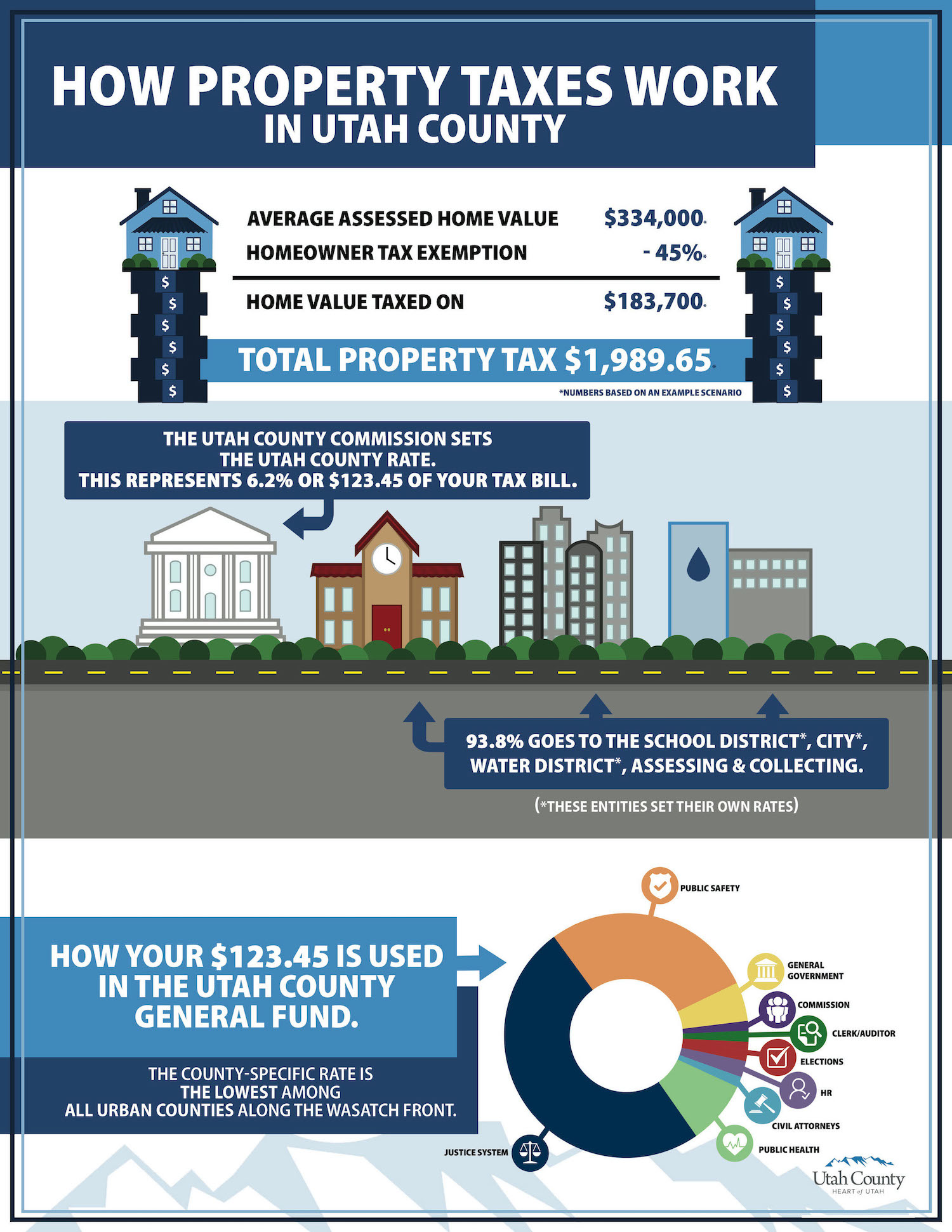

Utah County Property Tax Increase On The Horizon Lehi Free Press

Property Tax South Dakota Department Of Revenue

Relief Programs South Dakota Department Of Revenue

Location Matters Effective Tax Rates On Manufacturers By State Tax Foundation

Property Tax Comparison By State For Cross State Businesses

Property Tax Comparison By State For Cross State Businesses

Maine Dor Sales Use Tax Internet Filing Tax Quickbooks Internet