ri tax rate on unemployment benefits

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per. Under federal legislation enacted on March 11 2021 if a taxpayer received.

Free Rhode Island Payroll Calculator 2022 Ri Tax Rates Onpay

The range of tax rates for contributory employers in 2021 will be between 22 to 135 which is the Table F tax rate schedule.

. 10 percent 0 to 952512 percent 9526 to 3870022 percent 38701 to 8250024 percent 82501 to 15750032 percent 157501 to 20000035 percent. Rhode Island Department of Labor Training news. Your weekly benefit rate will be equal to 385 of the average of the total wages in the two highest quarters of the base period not to exceed the defined maximum amount.

Erica Guatieri a local certified public accountant CPA said under the plan recipients dont have to pay federal taxes on the first 10200 of unemployment benefits. Lima said I want to give this same benefit to Rhode Islands. Normally unemployment benefits are subject to both federal and Rhode Island personal income tax.

Most employers receive a. The Department of Labor and Training DLT today announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in. The maximum weekly benefit rate for Temporary Disability Insurance will increase to 978 per beneficiary an increase of 91 from the current weekly maximum benefit rate of.

The rate for new employers will be 23. Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes. Contributions collected from Rhode Island employers under this tax are used exclusively to pay benefits to unemployed workers.

The FUTA tax is 6 on the first 7000 of income for each employee. Contact each state where you have earned wages to determine where you prefer to file. 2022 Child Tax Rebate Program.

Your weekly benefit rate will be equal to 385 of the average of the total wages in the two highest quarters of the base period not to exceed the defined maximum amount. You can combine your Rhode Island RI wages with wages earned in other states. You must pay federal unemployment tax based on employee wages or salaries.

Under federal legislation enacted on March 11 2021 if a taxpayer received unemployment benefits in 2020 and the taxpayers federal adjusted gross income AGI was. For example that means if your weekly benefit amount is 100 you can earn up to. The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth R I Keeping Unemployment.

Job Development Fund Tax Employers pay. You can now earn up to 150 of your weekly benefit rate and still receive a partial benefit. The Rhode Island Department of Labor Training DLT announced that the 2021 SUI tax rates and taxable wage base increased.

The first 10200 received in unemployment benefits will not be taxed by the Federal Government.

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Ct Struggling To Pay Unemployment Claims Feds Holding Back Billions Pending New Rules

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

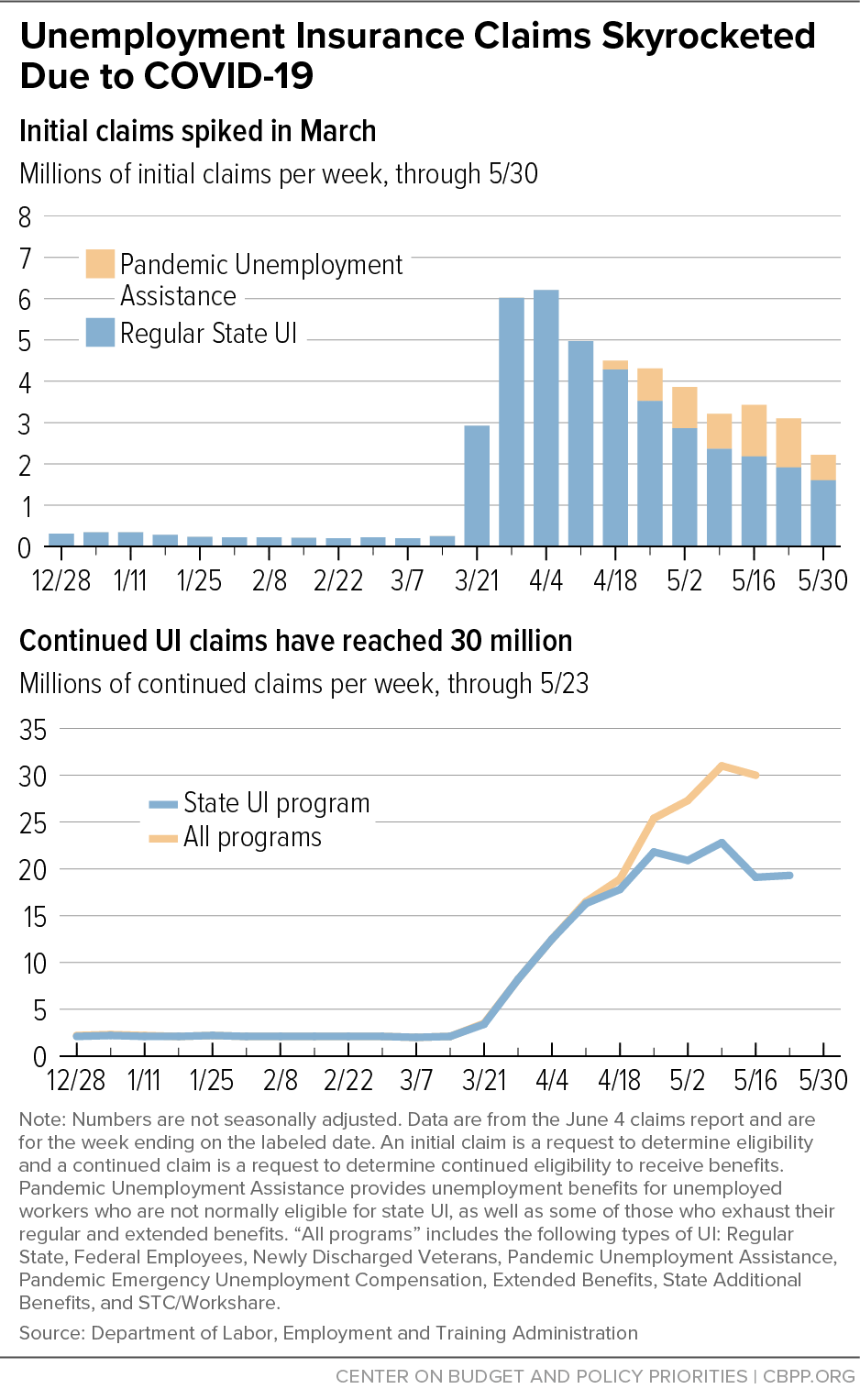

Cares Act Measures Strengthening Unemployment Insurance Should Continue While Need Remains Center On Budget And Policy Priorities

Prepare And E File Your 2022 2023 Rhode Island Tax Return

View All Hr Employment Solutions Blogs Workforce Wise Blog

1099 G Rhode Island Fill Out Sign Online Dochub

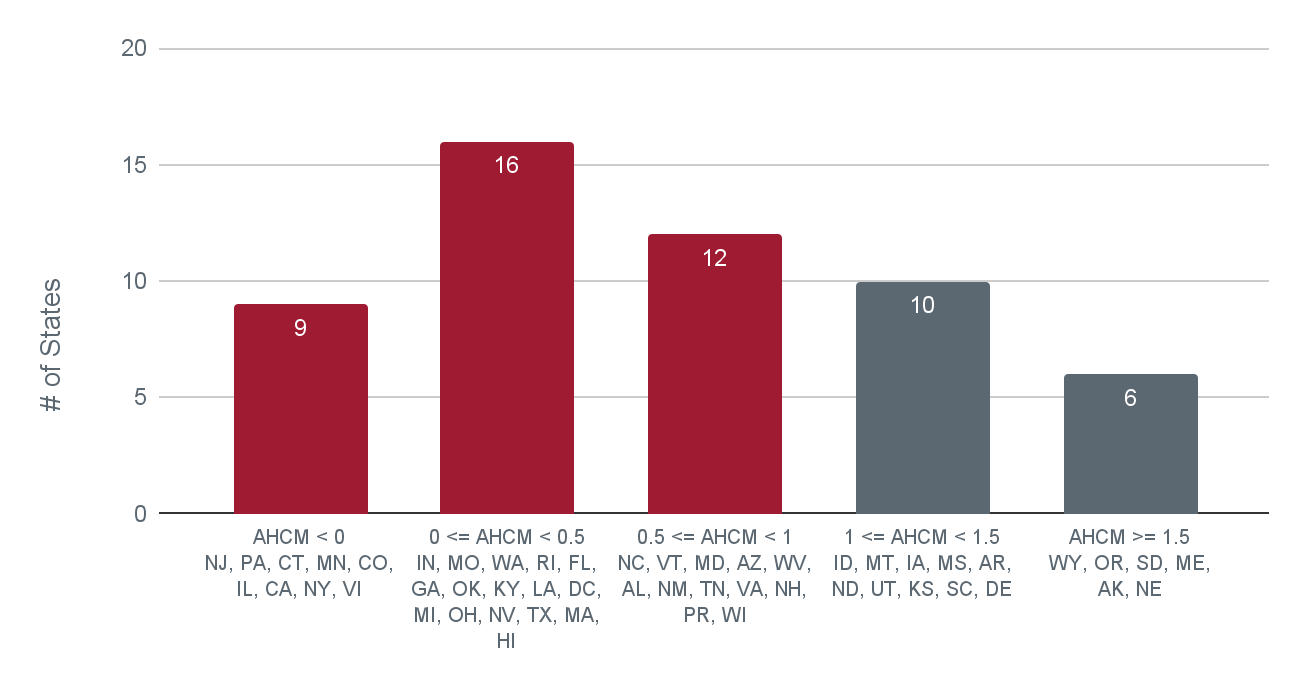

Taxes On Unemployment Benefits A State By State Guide Kiplinger

How To Replace Covid Relief Deadlines With Automatic Triggers That Meet The Needs Of The U S Economy Equitable Growth

Numerous States Announce 2022 Unemployment Tax Increases 501 C Services

View All Hr Employment Solutions Blogs Workforce Wise Blog

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

Apply For Unemployment Benefits Ri Department Of Labor Training

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

Rhode Island Employee Retention Credit Erc For 2020 2021 And 2022 In Ri Disasterloanadvisors Com

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Updated 300 Unemployment Benefits Boost Calculator Now Signed By Trump Forbes Advisor

Cares Act Measures Strengthening Unemployment Insurance Should Continue While Need Remains Center On Budget And Policy Priorities

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back